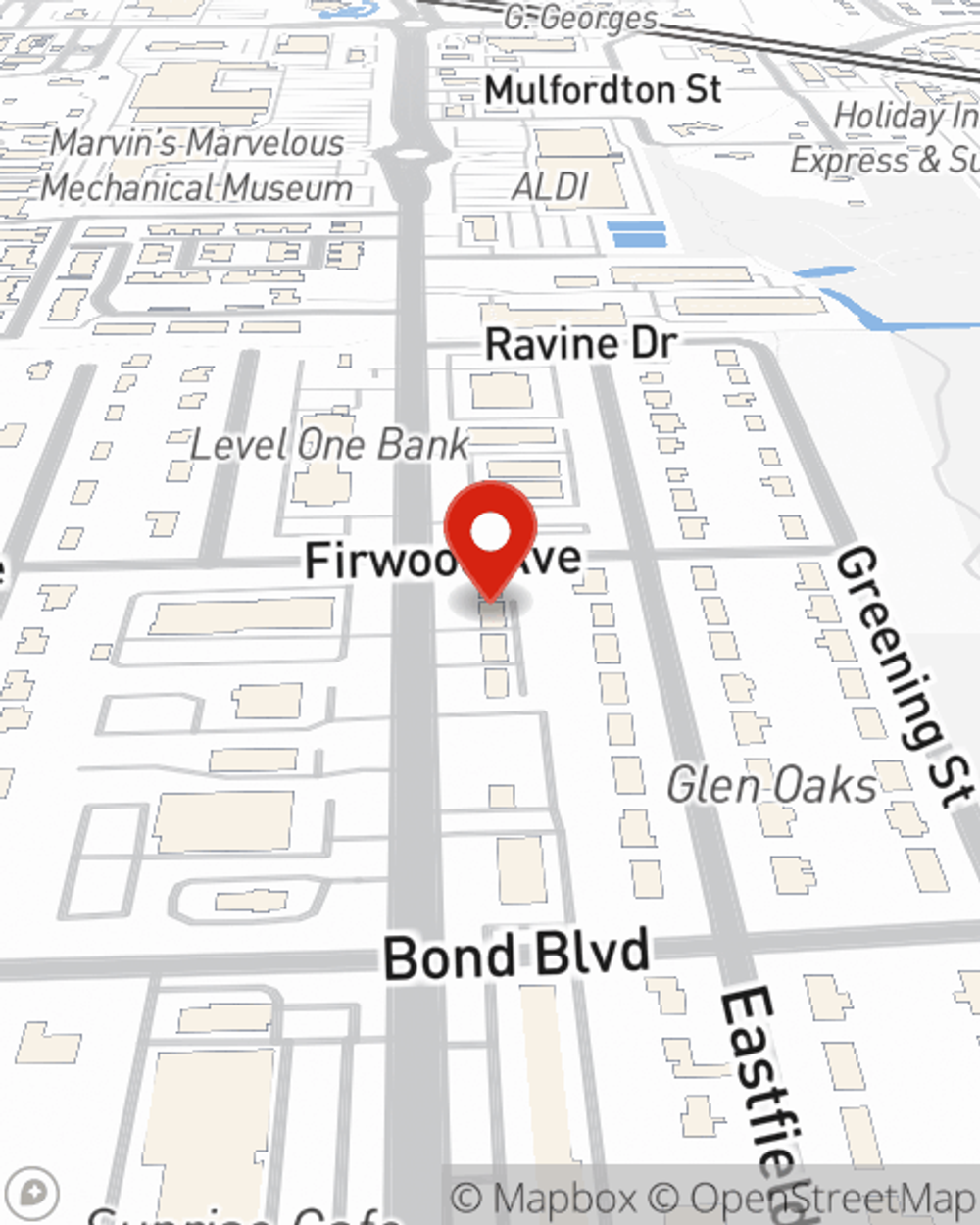

Business Insurance in and around Farmington Hills

Farmington Hills! Look no further for small business insurance.

No funny business here

- Farmington

- Novi

- Northville

- Bloomfield Hills

- West Bloomfield

- Walled Lake

- Milford Twp.

- South Lyon

- Troy

- Commerce Twp.

- Brighton

- Rochester Hills

- Livonia

- Canton

- Wixom

- Wolverine Lake

- Berkley

- Birmingham

- Clarkston

- Keego Harbor

- Waterford

- Orchard Lake Village

- Bloomfield

State Farm Understands Small Businesses.

Do you feel overwhelmed when it comes to owning your small business? It can be a lot to manage! Let State Farm agent Jay Swindle help you learn about quality business insurance.

Farmington Hills! Look no further for small business insurance.

No funny business here

Protect Your Business With State Farm

For your small business, whether it's a home cleaning service, a funeral home, a window treatment store, or other, State Farm has insurance options to help fit your needs! This may include coverage for things like business property, business liability, and computers.

It's time to call or email State Farm agent Jay Swindle. You'll quickly discover why State Farm is one of the leaders in small business insurance.

Simple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.

Jay Swindle

State Farm® Insurance AgentSimple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.